Sustainable Finance

What is Sustainable Finance?

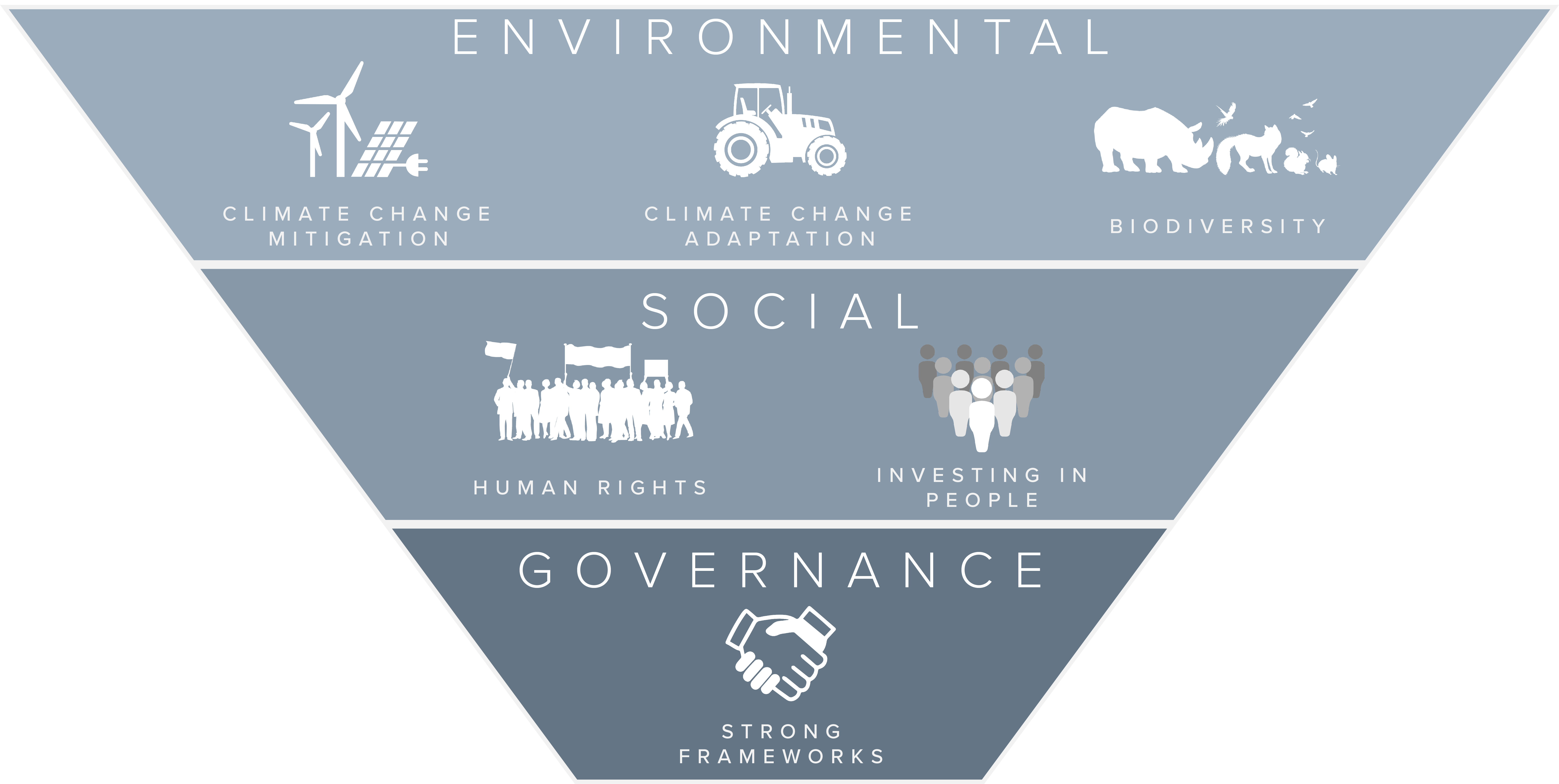

Sustainable Finance refers to the process of taking environmental, social and governance (ESG) considerations into account when making investment decisions in the financial sector, leading to more long-term investments in sustainable economic activities and projects.

Environmental considerations might include climate change mitigation and adaptation, as well as the environment more broadly, for instance the preservation of biodiversity, pollution prevention and the circular economy.

Social considerations could refer to issues of inequality, inclusiveness, labour relations, investment in people and their skills and communities, as well as human rights issues.

The governance of public and private institutions – including management structures, employee relations and executive remuneration – plays a fundamental role in ensuring the inclusion of social and environmental considerations in the decision-making process.”

A Vast Global Market

The Sustainable Finance Market size is already measured in multi-trillion dollar terms with very healthy annual compound growth rates predicted too.

Growing Interest

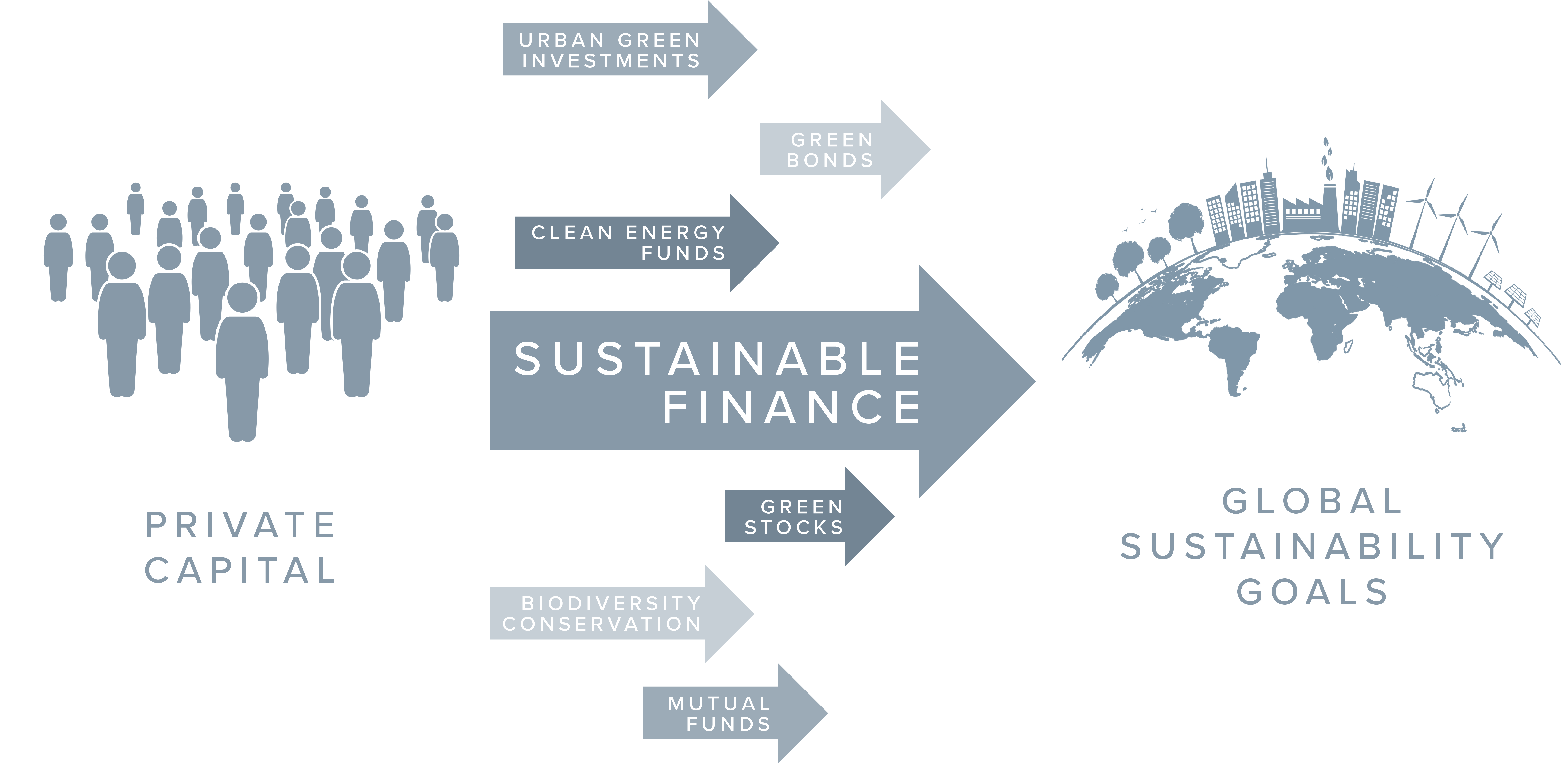

Demand for sustainable investments is two-fold: governments need private sector funds to meet climate-change commitments and consumers are seeking investments that meet their individual ESG values.

A World of Opportunity

The G20 estimates that the total investment required for “core infrastructure” to tackle climate change is US$75-86 trillion, representing a huge opportunity for green capital markets to grow.

More Investment is Required

According to the Climate Policy Initiative, investors contributed US$1.27 Trillion in 21/22 towards climate finance flows. However, this figure stills falls significantly short of the amount needed.

The Role of Financial Services

The Financial Services sector is crucial in addressing global social and environmental issues. It is, and will continue to be, pivotal in mobilising the necessary funds to meet global sustainability objectives, positively influencing corporate behaviour, bolstering governmental efforts towards a sustainable economy, and setting a precedent for others.

Our Role

Market indicators unanimously point towards a huge global flow of capital into sustainable financial products. As a leading international finance centre, with a broad diversification of financial services disciplines, the Isle of Man will have an important role to play in this evolution. Also, as the only entire-nation UNESCO Biosphere in the world, the Isle of Man has a unique opportunity to be at the vanguard of sustainable finance development.

Our Objectives

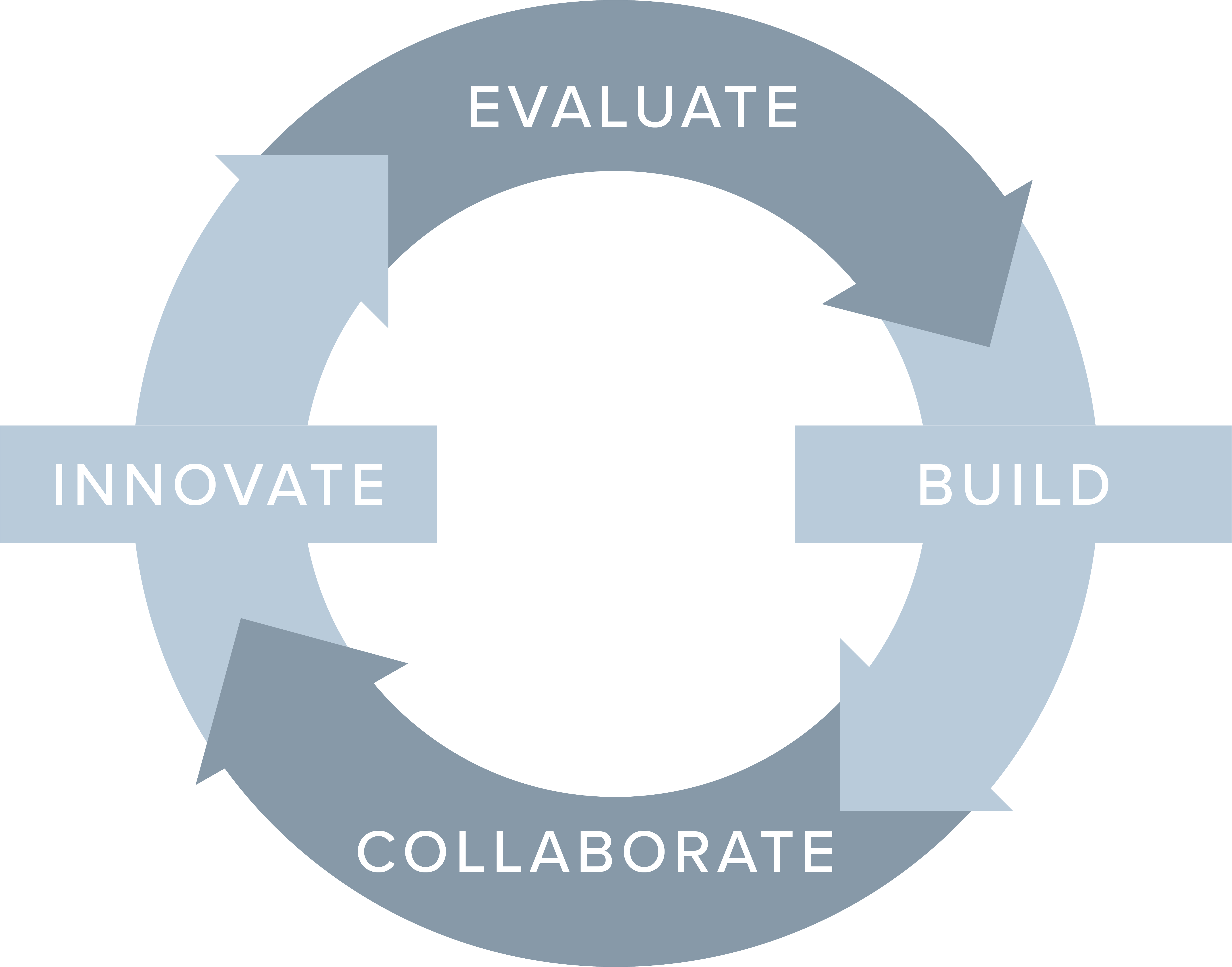

Our Approach

Our Sustainable Finance development journey is the responsibility of a public-private steering group with representatives from across government, regulator and the financial services industry. It will:

- Oversee an analysis of the Island’s current Sustainable Finance proposition and opportunities for innovation, leading to a development roadmap.

- Delegate workstreams for each roadmap milestone to dedicated working groups.

- Develop and maintain a comprehensive taxonomy for Sustainable Finance in the Isle of Man.

- Build lasting relationships with other financial ecosystems and international bodies to ensure the Island continues to work within global best practices for Sustainable Finance.