Regulated Funds

Find the Right Fund for Retail Investors

The Isle of Man recognises the increasing appetite for regulation from fund promoters and investors. The Regulated Fund is designed for fund promoters and investors seeking a regulated structure.

Regulated Funds

Find the Right Fund for Retail Investors

The Isle of Man recognises the increasing appetite for regulation from fund promoters and investors. The Regulated Fund is designed for fund promoters and investors seeking a regulated structure.

Why Choose the Isle of Man?

.

Key Features of the Regulated Fund

Click the dropdowns to find out more

Companies can be established under the more traditional Companies Act 1931 or the more flexible Companies Act 2006, which offers a stand-alone vehicle with minimal administrative requirements, flexible capital structure and limited disclosure requirements. Both types of company can be established as protected cell companies. Closed-ended investment companies which fall within the Isle of Man's fund regime may be established as Regulated Funds.

Isle of Man limited partnerships offer tax transparency and a flexible legal framework. A limited partnership may return capital prior to the winding up of the partnership. Furthermore, in order to provide comfort to investors, the statute sets out a “whitelist” of activities that will not result in limited partners being regarded as involved in the management of the partnership, thereby prejudicing their limited liability status.

Isle of Man trust law is similar to that of England and Wales. As a fund vehicle, the unit trust arrangement offers huge flexibility.

The investors of a Regulated Fund are not required to satisfy any specific entry criteria, unless imposed by the fund itself.

A Regulated Fund must appoint a fund manager that is licensed in the Isle of Man by the Isle of Man Financial Services Authority (IOMFSA).

In order to establish a Regulated Fund, application must be made to the IOMFSA by the proposed manager requesting permission to act. Permission is granted for the manager to act in relation to a specific Regulated Fund or Regulated Funds.

The manager, along with the governing body, is responsible for ensuring that the Regulated Fund is managed and operated in accordance with its constitutional and offering documents, and that it is compliant with the Collective Investment Schemes (Regulated Fund) Regulations 2017 (“Regulations”).

The manager is also responsible for ensuring that adequate and appropriate procedures and controls are implemented for operation of the Regulated Fund including, for example, corporate governance arrangements, complaints procedures, issue of contract notes and monitoring the Regulated Fund's liquidity profile. The manager oversees promotion of the Regulated Fund by the promoter.

The manager must obtain the IOMFSA's approval to any material alterations to the fund structure or its constitutional or offering document.

A Regulated Fund must appoint a fiduciary custodian or trustee whose responsibilities include the implementation of appropriate procedures and controls to satisfy itself that the Regulated Fund is being managed and operated in accordance with its constitutional and offering documents. The fiduciary custodian or trustee is also responsible for custody of the Regulated Fund's assets.

The fiduciary custodian / trustee of a Regulated Fund must be a different person from the manager and either be an Isle of Man licensee or authorised to act as trustee or fiduciary custodian (as the case may be) of a collective investment scheme under the law of any country or territory acceptable to the IOMFSA.

Any sub-custodian appointed to the Regulated Fund must be an Isle of Man licensee or alternatively, licensed in another jurisdiction to provide custody services to this type of fund. The sub-custodian must not be the manager or a subsidiary of the manager.

All members of the governing body of a Regulated Fund must complete and submit fitness and propriety assessment forms to the IOMFSA. With the exception of funds constituted as unit trusts, the governing body must include at least 1 natural person who is resident in the Isle of Man.

The governing body of a Regulated Fund has responsibility for ensuring that the fund complies with its regulatory requirements and, amongst other things, for ensuring that the fund's offering documents are compliant with the Regulations and contain all material information.

Along with the manager, the governing body is responsible for ensuring that the Regulated Fund is managed and operated in accordance with its constitutional documents and offering document, and that the obligations of the manager under the Regulations are discharged.

The governing body is required to sign and file a statement of responsibility in relation to the initial and any amended offering document.

The Irish Stock Exchange has confirmed to the IOMFSA that the Regulated Fund is suitable for listing on the Irish Stock Exchange without the imposition of a €100,000 investment threshold criteria.

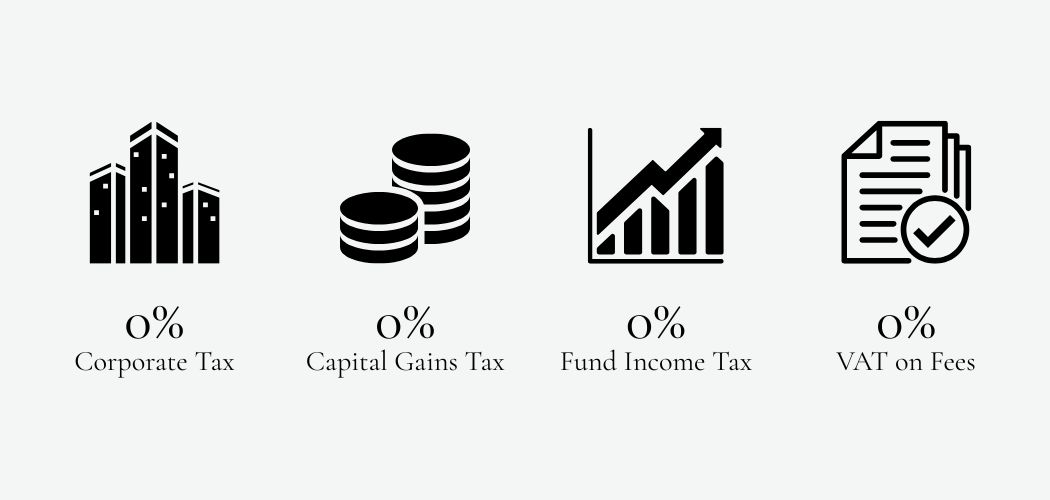

Taxation

The Isle of Man offers a tax neutral environment for fund operations. Simply put, there are no capital taxes and a zero rate of corporate tax for fund companies. This means that a corporate fund vehicle will benefit from a zero rate of income tax, as will any fund management or administration business based in the Isle of Man.

Fees levied by fund administrators and investment managers based in the Isle of Man in respect of fund management services to Regulated Funds are exempt from value added tax in the Isle of Man. More of the investment returns stay with the investors.

Need More Information?

Download the Isle of Man Regulated Funds Factsheet for free through the link below.

Get Started

With its pro-business regulatory environment, fast setup, and global distribution potential, the Isle of Man is an ideal jurisdiction for fund administration.