Specialist Funds

Find a World-Class Investment Vehicle

The Isle of Man prides itself on creating the right business environment with pragmatic regulation. The fund category of choice for institutional alternative investment is the Specialist Fund.

Specialist Funds

Find a World-Class Investment Vehicle

The Isle of Man prides itself on creating the right business environment with pragmatic regulation. The fund category of choice for institutional alternative investment is the Specialist Fund.

Why Choose the Isle of Man?

.

Key Features of the Specialist Fund

Click the dropdowns to find out more

Companies can be established under the more traditional Companies Act 1931 or the more flexible Companies Act 2006, which offers a stand-alone vehicle with minimal administrative requirements, flexible capital structure and limited disclosure requirements. Both types of company can be established as Protected Cell Companies or 'PCCs‘. PCCs are ideal for use in both multi-class/single manager structures and in multi-manager offerings.

If corporate structures are not suitable, Isle of Man limited partnerships offer tax transparency and a flexible legal framework. A limited partnership may return capital prior to the winding up of the partnership. Furthermore, in order to provide comfort to investors, the statute sets out a “whitelist” of activities that will not result in limited partners being regarded as involved in the management of the partnership, thereby prejudicing their limited liability status.

As a fund vehicle, the unit trust arrangement offers huge flexibility. Manx trust law is similar to that of England and Wales.

Pragmatism reigns with no regulatory restrictions on asset classes, trading strategies or leverage for a Specialist Fund. This means that the Specialist Fund is suitable for any type of alternative investment fund. However, in the interests of investor protection it is a requirement that a Specialist Fund must receive (either directly or indirectly) investment advice or management services from an appropriate entity that is acceptable to the fund's governing body.

An asset manager or investment advisor may be established in the Isle of Man to act for the Specialist Fund and, subject to certain conditions, may be exempt from licensing.

A Specialist Fund will need to appoint a regulated fund administrator to perform its core administration requirements, valuations, pricing and fund accounting services. Whilst already a low cost jurisdiction we recognise the need for flexibility, therefore, whilst this role may be fulfilled by an Isle of Man based service provider, it is not a mandatory requirement. However, the appointed administrator must be based in a jurisdiction that the Financial Services Authority ("FSA") regards as providing an acceptable level of regulation and mutual assistance arrangements.

The administrator has regulatory responsibilities for ensuring that the target investor requirements for a Specialist Fund (see overleaf) are met, making certain periodic reports and declarations of compliance to the FSA and notifying the FSA of certain material events in relation to the fund.

There are no prescriptive requirements for the appointment of a custodian in relation to a Specialist Fund. The fund is free to appoint various custodians or prime brokers as it sees fit and may appoint different parties to act in relation to different types or groups of assets. However, the arrangements for the custody of the assets of the Specialist Fund must be described in the offer document.

There is no requirement for any pre-approval to be sought from the FSA or any other body. This means that a Specialist Fund can be launched quickly and without any risk of regulatory delays.

The governing body of a Specialist Fund has responsibility for ensuring the Fund complies with its regulatory requirements and, amongst other things, ensuring that the fund's offering document is compliant and contains all material information. It is also required to make certain that the fund is managed and operated in accordance with its constitutional documents and offering document. An independent non-executive director must be appointed to the governing body of a Specialist Fund (with the exception of funds constituted of unit trusts).

It is important to note that where an overseas administrator has been appointed, there is a requirement to appoint an Isle of Man resident director who is either licensed as a fiduciary or working for a licensed fiduciary services provider. The Isle of Man resident director is required to monitor compliance by the overseas administrator with the Specialist Fund requirements. Where the fund is constituted as a unit trust and appoints an overseas administrator, the governing body must be licensed by the FSA.

The Specialist Fund is aimed at institutional and non-retail investors.

Prospective investors must certify that they are sufficiently experienced to understand the risks associated with an investment in the Specialist Fund in question and must fall into one of the categories of permitted investor. Broadly speaking, these cover institutional investors, affiliates of the fund's promoters and managers, and individuals with a net worth in excess of US$1m.

There is a minimum initial investment requirement of at least US$100,000 (or its foreign currency equivalent). The administrator is required to ensure that compliance with the minimum investment threshold is met.

Taxation

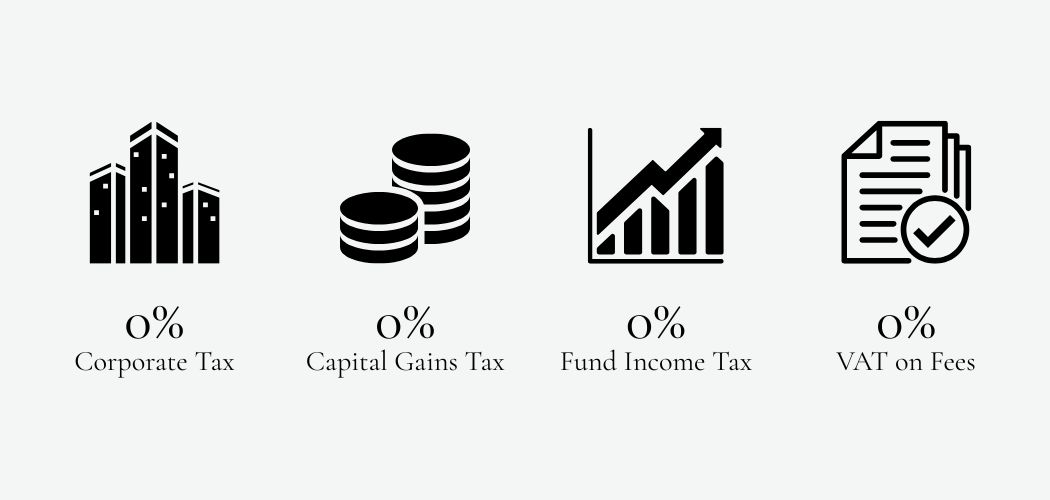

The Isle of Man offers a tax neutral environment for fund operations. Simply put, there are no capital taxes and a zero rate of corporate tax for fund companies. This means that a corporate fund vehicle will benefit from a zero rate of income tax, as will any fund management or administration business based in the Isle of Man.

Fees levied by fund administrators and investment managers based in the Isle of Man in respect of fund management services to Specialist Funds are exempt from value added tax in the Isle of Man. More of the investment returns stay with the investors.

Need More Information?

Download the Isle of Man Specialist Funds Factsheet for free through the link below.

Get Started

With its pro-business regulatory environment, fast setup, and global distribution potential, the Isle of Man is an ideal jurisdiction for fund administration.